Lord Kulveer Ranger Raises First Leading Oral Question on Stablecoins in House of Lords

- October 16, 2025

- Posted by: admin

- Category: News

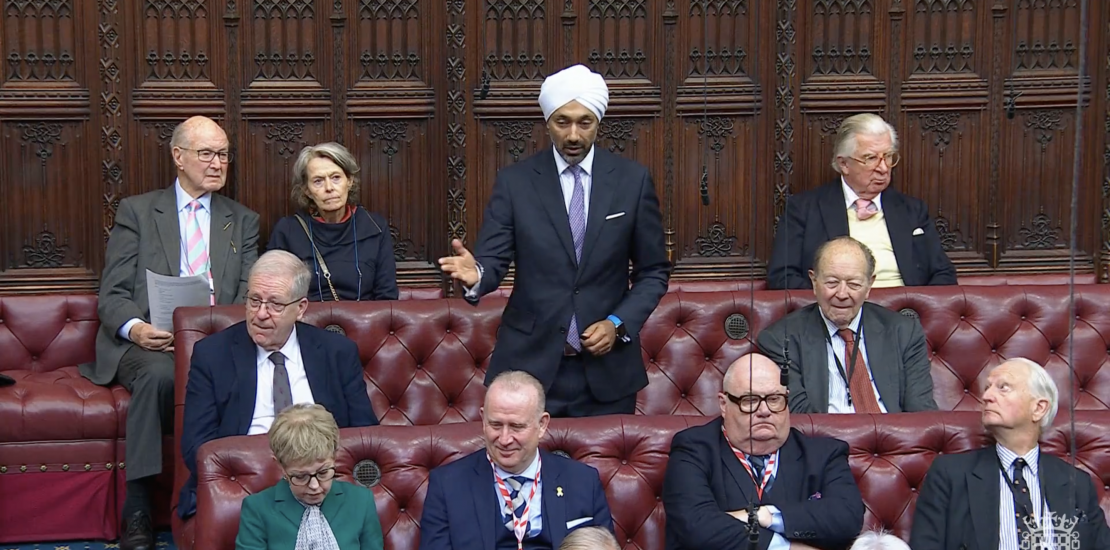

In a historic first, Lord Kulveer Ranger, Co-Chair of the All-Party Parliamentary Group on Digital Markets and Digital Money (APPG DMDM), led the first ever oral question in the House of Lords on Stablecoins — marking a significant moment in the UK’s evolving conversation around digital assets and financial innovation.

Setting the Tone for the UK’s Digital Finance Future

The question addressed the Government’s approach to stablecoin regulation, calling for the UK to show clarity and ambition in enabling innovation while maintaining a secure and transparent financial system.

Stable coins are growing across the world in their usage. At the beginning of this year, $200 billion worth have been issued, by September this year $280 billion. Pushed by the emergence of the Genius Act in the US and MiCA in the in Europe, these regulatory frameworks have enabled corporates to take advantage of the ability of moving money with agility and confidence and real time liquidity. So can I ask, how are we looking to keep up with the pace of the rest of the world as the use of stable coins is looking to reach 1.9 trillion by 2030 and that is distinctly providing a competitive advantage to businesses and industry in other geographies.

– Lord Kulveer Ranger, October 2025, Lords Questions

Response:

Stablecoins have a huge potential to play a significant role in both retail and wholesale payments. We’re already seeing the benefits of stable coin can provide in cross border payments, for example, by reducing costs and improving efficiencies. So I think he’s absolutely right to say it’s important for the UK to harness these opportunities for the ongoing competitiveness of the UK financial services sector, I don’t think, though, it’s fair to say that the US is particularly going any faster than the UK. I think you reading media coverage, you may conclude that, but I think the reality is that the US passed legislation for the regulation of stable coin in the summer. US regulators will publish their regulatory rules in mid 2026 with a backstop date of January 27 for the US regime to go live in the UK. The Government published draft legislation in April, with the final legislation due before the end of the year. And alongside this, the FCA is an advanced stage in its consultations on the details of its regime with a view to finalise its detailed rules and requirements in 2026 this will allow firms to be authorised and running in the UK regime by 2027.

Why Stablecoins Matter

Stablecoins are emerging as a foundational technology for cross-border payments, providing infrastructure for 24/7 liquidity and real-time money movement.

With more than $280 billion in circulation as of September 2025, and projections exceeding $1.9 trillion by 2030, the market is rapidly expanding — and jurisdictions around the world are moving decisively to shape its future.

- 🇺🇸 GENIUS Act – No ownership limit

- 🇪🇺 MiCA Act – No ownership limit

- 🇦🇪 VARA Dubai – No ownership limit

- 🇬🇧 Bank of England – Consulting on potential ownership limits

Lord Ranger challenged whether the UK will seize this opportunity or allow others to lead, underscoring the importance of maintaining the nation’s competitiveness in the digital economy.

Championing Innovation Through Policy

Through the APPG on Digital Markets and Digital Money, Lord Ranger continues to advocate for evidence-based, forward-thinking regulation that enables responsible innovation while upholding financial integrity and consumer confidence.

This parliamentary question forms part of a broader series of APPG engagements, including sessions with industry leaders, academics, and regulators, to define a clear path for the UK’s digital money strategy.